Online Trading - Stock Charts and Candlestick Charts

Online Trading Made Easy

In a previous post we explained the importance of understanding the basics of stock market charts and technical analysis - Stock Market Charting for Beginners - with the charts at a critical point right now it is essential to have an idea of how to understand the charts.

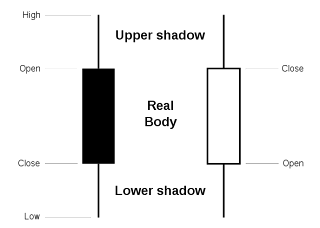

One method stock traders are using increasingly is Japanese Candlesticks. This is a system of chart analysis devised in the 18th century by Japanese rice trader Homma Munehisa. They are used on the stock market today to show the high, low, close and opening price of a share. In addition the high and low prices are shown by a thin ine referred to as the wick. The open and close prices represent the body of the. You don't draw the candles yourself of course, although you can, any stock charting site or software package will show you the charts in either candlestick form or as a straight line or as a bar chart.

One method stock traders are using increasingly is Japanese Candlesticks. This is a system of chart analysis devised in the 18th century by Japanese rice trader Homma Munehisa. They are used on the stock market today to show the high, low, close and opening price of a share. In addition the high and low prices are shown by a thin ine referred to as the wick. The open and close prices represent the body of the. You don't draw the candles yourself of course, although you can, any stock charting site or software package will show you the charts in either candlestick form or as a straight line or as a bar chart. Candlestick charts indicate the supply and demand for a parituclar sotck or index or commodity over a given period of time and whether there were more buyers than sellers. If the candlestick is long and white then the buyers outnumbered the sellers, if the candlestick is black then sellers outnumbered the buyers over the period of time being analysed.

A long wick on the candle means that there was a lot of volatility but the closing price ended up being near to the opening price. If the wick is underneath the body the sellers were in control at the beginning of the day but the buyers gained control towards the close. If the wick is on the top then the buyers were in control at the start of the period but the sellers gained control towards the close.

A short candlestick means that there was not much volume or there was a struggle between buyers and sellers but neither won.

An important point to note is that if short candlesticks appear at the top of a long uptrend or downtrend then this may mean the trend is changing.

The video below made by www.informedtrades.com makes it all clearer.

Whether you choose to use candlestick charts or not it is very important to understand the importance of charts and one rule that it is worth bearing in mind is never to buy a stock or an index when the price is below the 200 day moving average.

Home : Online Trading Made Easy

Related Post : Stock Charting for Beginners